If you believe you'll require this back-up plan in location, it's not a poor concept to add this to your policy. Pay-Per-Mile Protection If your vehicle tends to sit in the garage gathering dust, you might be interested in pay-per-mile coverage. With this coverage, a general practitioner device is installed in your automobile so you're billed per mile, as opposed to a yearly quote.

Glass Insurance coverage If you live beside a fairway, you might have located on your own wishing you had glass insurance coverage to spend for the expense of fixing or changing the home windows on your auto - cheap insurance. Some insurance coverage firms use glass coverage with no insurance deductible, yet the cost of the included protection might surpass the advantages, particularly with some plans only covering the windscreen.

That makes a lot more sense! Whatever you end up doing, there are whole lots of methods to reduce car insurance policy. As well as if you've come across something called a "disappearing insurance deductible," no, it's not a magic method (low cost). Your payments most definitely won't disappear into thin air. Some insurance business offer vanishing deductibles at an additional price for drivers with a lengthy background of safe driving.

trucks auto vehicle cheapest car insurance

trucks auto vehicle cheapest car insurance

If your insurance deductible is $500 as well as you have actually been accident-free for five years, your deductible would certainly go to $0. Factoring in the added price of the protection, you're normally much better off conserving that money to put towards your financial debt snowball or emergency situation fund.

If you avoid of trouble for a little while, your costs will at some point return down-to-earth. An additional point that can cause your premium to rise is if you're frequently submitting insurance claims. credit. If you have $250 worth of work thanks to a fender bender, you may not desire to file that claim.

An Unbiased View of Car Insurance Calculator - How Much Insurance Do You Need?

It's also very easy to think you have enough while really being underinsured - cars. Your goal is to discover your auto insurance sweet area. The very best way to do this is by collaborating with an independent insurance representative that belongs to our Backed Local Companies (ELP) program. These insurance policy pros are Ramsey, Relied on and also can consider your unique scenario to discover you the most effective security at the right cost.

Researching for the appropriate insurer that fulfills your needs is typically the very first action, yet you likely have inquiries regarding insurance service providers, policies, and rates. insurers. When comparing quotes, you may wonder, what is the average price of automobile insurance? It's valuable to understand the variables that can affect your cars and truck insurance expenses.

On a yearly basis, automobile insurance coverage expenses normally drop in between $926 and $2,534 each year per automobile, however these expenses can differ based upon the place, supplier, as well as protection picked. insurance. Here are several of the aspects that influence the price of cars and truck insurance: State and also place Your geographical place might play a vital function in determining the premium amount for your automobile insurance policy - car.

cheap auto insurance accident insurance companies

cheap auto insurance accident insurance companies

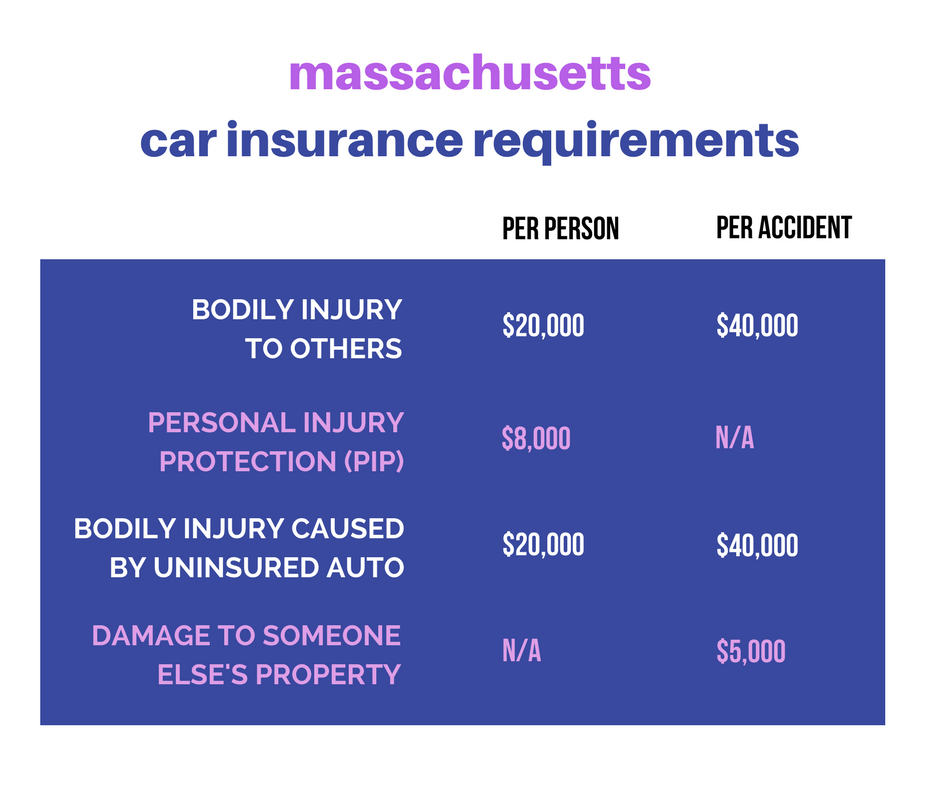

Some states likewise require Injury Security (PIP) coverage and also some locations take into consideration climate and climate when establishing auto insurance prices. Learn more about what vehicle insurance coverage is required in your state. Age As a vehicle driver with reliable vehicle insurance, your rates will likely rise and fall in time, depending on your age. vehicle insurance.

This is normally due to inexperience as well as unsafe driving habits. Based on this information, teen and also elderly vehicle drivers might pay more when acquiring automobile insurance than middle-aged chauffeurs.

Best Car Insurance For Young Drivers for Beginners

New cars can be costly to insure since they come with new components as well as greater replacement worths than older makes and versions. Lorry dimension can additionally affect automobile insurance costs.

cheap insurance cheap auto insurance insured car

cheap insurance cheap auto insurance insured car

Annual mileage When looking into just how much automobile insurance policy must cost, bear in mind that insurance premiums are based mostly on the threat related to your car. High-mileage motorists are taken into consideration much more likely to be in a crash than lower-mileage motorists. Many insurance service providers consider your annual mileage together with additional variables like travelling miles to establish your car insurance expense and if you get approved for low-mileage price cuts - trucks.

Study reveals that a higher credit rating integrated with no previous crash insurance claims and safe driving background can aid you receive reduced insurance coverage rates. Driving record Your driving record helps address the concern: exactly how much should I be spending for cars and truck insurance? Vehicle insurance coverage companies frequently focus on a person's experience and driving record.

A married vehicle driver can pay up to $96 much less per year for their cars and truck insurance policy. Combining vehicle insurance with house insurance policy is an easy way to conserve on your automobile insurance policy costs.

Sufficient insurance policy coverage ensures most of those expenses will go to your insurance provider, rather of to you. Loan provider requirements: If you funded or leased your lorry, the loan provider will likely require even more insurance coverage than your state's minimums (auto). That's due to the fact that the loan provider legitimately has the automobile and requires to guarantee it's economically secured in instance of a crash or other damage.

How Nj Needs To Ban Car Insurance Companies From Using Credit ... can Save You Time, Stress, and Money.

What Occurs if I Do Not Have Car Insurance Policy? Driving without car insurance policy is a catastrophe waiting to take place.

For more detail, we developed a total guide to collision insurance coverage. Not needed by regulation, however generally called for by a lienholder on a rented or funded vehicle. This insurance coverage covers damage to your car triggered by events besides a collision, such as vandalism, burglary, flooding, hail, as well as fire damage (insurance company).

Needed in several states. This protection spends for your and also your guests' medical bills as well as building damage if the motorist to blame in an accident does not have insurance policy, has not enough protection, or the incident is a hit-and-run (low cost). Read our total guide on without insurance driver insurance coverage for more information. Optional in a lot of states, this covers your medical Helpful site bills, despite who is at fault in an accident.

Generally required for an auto that is rented or financed. "Void" means "guaranteed property protection," as well as if your funded auto is amounted to in a crash, this insurance coverage covers the void between the vehicle's worth and also the equilibrium on your funding. This insurance coverage is especially important when the auto is brand-new, given that it will normally depreciate much faster than you'll pay for the lending balance. cheap car insurance.

low cost auto cheap car insurance credit car

low cost auto cheap car insurance credit car

Supplemental protection for drivers of ride-hailing solutions like Uber as well as Lyft. A rideshare plan is generally cost-effective, though it provides important insurance coverage for scenarios that are not covered by a motorist's personal car insurance policy or the rideshare firm's insurance plan. If you are a rideshare vehicle driver, discuss your choices with your insurer. cheaper auto insurance.